This Week In DeFi – September 9

This week, Ethereum activates its Bellatrix upgrade, Binance removes USDC markets and Coinbase goes against the US Treasury over Tornado Cash sanctions.

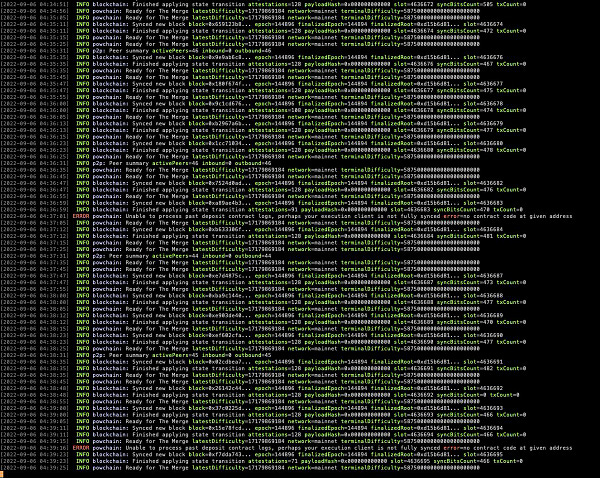

This week, Ethereum’s Bellatrix upgrade has been successfully activated – the final preparatory step before the Merge next week. Bellatrix was an important step on the Beacon Chain, adding a vital “execution payload” parameter for nodes to be able to process transactions post-Merge.

The Merge will be activated via the “Paris” upgrade at a Terminal Total Difficulty (TTD) of 58750000000000000000000, estimated to occur September 14-15.

Binance has removed USDC as an independent tradable asset – converting USDC, USDP and TUSD deposits into BUSD, its own Binance USD stablecoin. The exchange says the move is designed to improve liquidity and capital efficiency.

Users will still be able to make withdrawals in USDC, USDP and TUSD at a 1:1 ratio to their BUSD account balance.

Multiple employees from crypto exchange Coinbase are filing a suit to challenge the US Treasury’s sanctions on Tornado Cash.

The suit challenges the authority of the Treasury to sanction smart contract code, rather than a person or entity. The distinction between smart contract and individual crypto address is a highly important one, with potentially profound implications for the future of blockchain apps.

Curve Finance has released front-end code on GitHub for its upcoming crvUSD stablecoin, giving away some clues to features on the new token. So far, it appears that crvUSD may be an over-collateralized stablecoin, backed by ETH or one or more of Curve protocol’s largest liquidity pools.

Ethereum’s Merge looks as though it will be happening right on time, as US regulators decide to crack down on crypto mining and its energy consumption. The shift to Proof-of-Stake (PoS) will place Ethereum out of the way of any mining-based regulation, meanwhile Proof-of-Work (PoW) miners on Bitcoin or Ethereum forks may have to go green, or even worse – shut down altogether.

Implications of the research and the subsequent outcomes could be substantial for the future of Bitcoin within the country and elsewhere, as the EU seems to be heading down the same path.

Ethereum staking may also get a boost from large players, as SEBA bank pushes to provide staking services to institutions.

The threat of regulation also looms over stablecoins, as Fed Chair Jerome Powell calls for legislation to tame the ever-growing stablecoin market. Centralized stablecoins will be the first to feel the heat, adding to the pressure of the inter-stablecoin wars already in motion.

USDC has been effectively scrubbed from Binance, as the exchange giant consolidates USDC balances into Binance USD (BUSD), in an effort to improve liquidity and BUSD dominance.

On the horizon, we also have Curve’s stablecoin, expected to launch shortly after the Merge. The finer details of the token are still yet to be disclosed, however one thing is for certain – the sheer size of the protocol and its influence in DeFi will ensure that crvUSD captures a significant market share.

Interest Rates

DAI

Highest Yields: Nexo Lend at 10% APY, BlockFi at 6.38% APY

MakerDAO Updates

DAI Savings Rate: 0.01%

Base Fee: 0.00%

ETH Stability Fee: 0.50%

USDC Stability Fee: 1.00%

WBTC Stability Fee: 0.75

USDC

Highest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY

Top Stories

SEBA Bank to provide Ethereum staking services to institutions

Powell: ‘We need legislation’ on stablecoins

First Mover Americas: Bitcoin Back Over $19K as ECB Goes for Record Interest-Rate Hike

White House report proposes possible restrictions on proof-of-work crypto mining

Stat Box

Total Value Locked: $58.35B (down 2.2% since last week)

DeFi Market Cap: $49.60B (up 13%)

DEX Weekly Volume: $11B (down 15%)

Bonus Reads

[Kristin Majcher – TheBlock] – DeFi investing platform Credix raises $11 million in Series A round

[Oliver Knight – CoinDesk] – Crypto Lender Nexo Introduces Spot and Margin Trading Platform

[Samuel Haig – The Defiant] – Arbitrum Transactions Quadruple After Upgrade