This Week In DeFi – September 30

This week, USDC plans expansion to 5 more networks, Chainlink partners with SWIFT and launches a growth program, and Robinhood launches its own Web3 wallet.

To the DeFi community,

This week, USDC issuer Circle has announced that it will be expanding USDC natively to five new blockchains: Aributrum One, NEAR, Optimism, Polkadot and Cosmos.

The company will also launch its own cross-chain transfer protocol to improve the ease of movement of USDC tokens across the different blockchains. USDC will be available on a total of 14 blockchains after the expansion is complete.

Censorship remains an issue, however, with talks of blocking USDC from entire IBC channels on Cosmos if necessary.

1/ Another exciting announcement just shared at #ConvergeSF22 👀 we intend #USDC to be available on @arbitrum @cosmos @NEARProtocol @optimismFND @Polkadot

Chianlink has made headlines for a pair of reasons, the first being its announcement of its Sustainable Chainlink Access for Layer 1 and 2 Enablement (SCALE) program – aimed at growing decentralized applications by lowering cost barriers to oracle services.

Secondly, Chainlink has engaged in a partnership with global payments network SWIFT, in a proof-of-concept project that will test SWIFT messaging to instruct on-chain token transfers.

SWIFT is using the Cross-Chain Interoperability Protocol (CCIP) in an initial proof of concept. CCIP will enable SWIFT messages to instruct on-chain token transfers, helping the SWIFT network become interoperable across all blockchain environments. youtu.be/6DgnHKTI-EU

Mainstream trading app Robinhood has launched its non-custodial crypto wallet in beta, with access to 10,000 waitlisted customers on iOS. The app will have USDC as its primary stablecoin, as well as a rewards center.

The initial version of the app is integrated with the Polygon network only, however Robinhood claims that multiple networks will be supported in the future.

A wallet worth the wait. Beta testing is now live for 10K customers from the waitlist, with @0xPolygon as the first blockchain supported. You could be next: rbnhd.co/web3-wallet

Ribbon Finance has announced its own crypto options trading platform, called Aevo. The project will build upon Ribbon’s existing "DeFi Option Vault", a yield-generating instrument based on options and derivatives.

Aevo will be launched in closed beta in October, with plans to launch to the public before the end of 2022. Ribbon has high expectations for the product, predicting up to $100 million in daily trading volume within 6 months of its launch.

Our team has had their heads down working hard on building @aevoxyz with the goal of making it the world’s most advanced crypto derivatives exchange. Eventually, Aevo will be integrated with Ribbon as the venue where Ribbon's options contracts settle — and gradually other DOVs.Censorship is an issue that continues to surface in recent discussion, as the centralized aspects of the ecosystem reveal themselves as more and more threatening to the ethos of crypto.

Two primary demonstrations of this have made themselves headlines this week, with potentially major implications for the wider cryptosphere.

The first of these surrounds the control of a single entity and token, in the form of USDC – the second-largest stablecoin in the market today. Those involved in USDC’s integration into Cosmos have demonstrated a worrying willingness to block entire apps and chains from USDC if required.

Being such a major component of DeFi as we know it today, USDC’s expansion into Layer-2 platforms and other blockchains should be treated with caution. Although the problem may seem restricted to USDC, it is likely to grow to affect other centralized stablecoins too, as regulators formally enact rules and begin to enforce them for the asset class.

The second censorship issue that has reared its head is on the deeper protocol level, as up to one-quarter or more of all Ethereum blocks are now actively censoring Tornado Cash-affiliated transactions, via a service called Flashbots.

Although I’ve mentioned this outcome likely occurring, it is worrying to see the crypto ecosystem slipping slowly into a garden-walled environment – subject to the approval and whim of external actors.

Of course, this is still just the tip of the iceberg for censorship and regulatory influence on crypto. How far it will go – and how we will respond – is yet to be seen.

Interest Rates

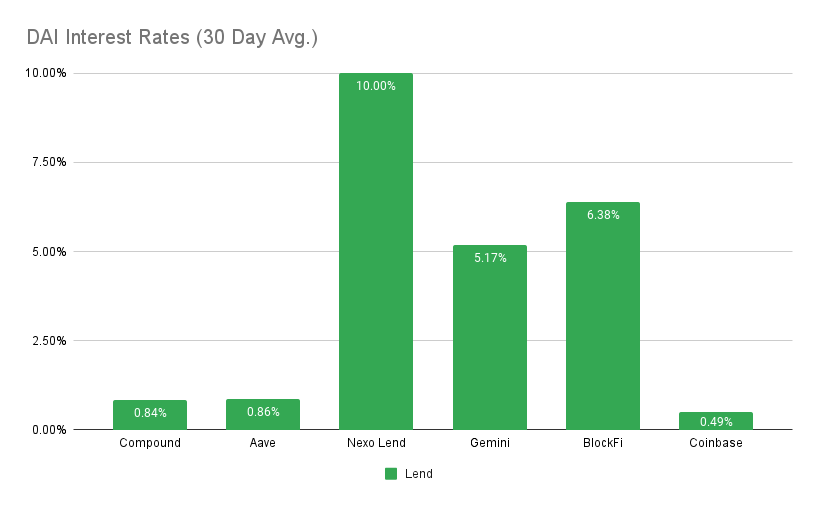

DAI

Highest Yields: Nexo Lend at 10% APY, BlockFi at 6.38% APY

MakerDAO Updates

DAI Savings Rate: 0.01%

Base Fee: 0.00%

ETH Stability Fee: 0.50%

USDC Stability Fee: 0.00%

WBTC Stability Fee: 0.75

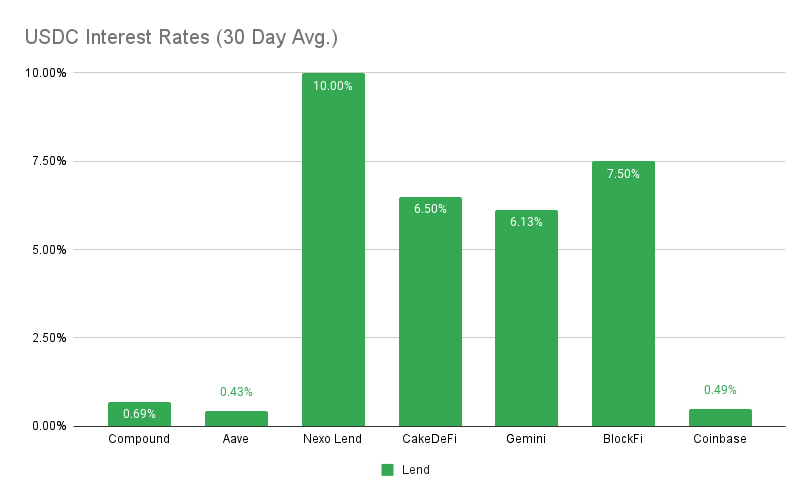

USDC

Highest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY

Top Stories

FTX Wins Voyager Digital's Asset Auction

At least 23% of Ethereum blocks are complying with US sanctions

Nexo Buys Stake in Federally Chartered US Bank Summit National

Celsius CEO resigns as company struggles to pay back creditors

Stat Box

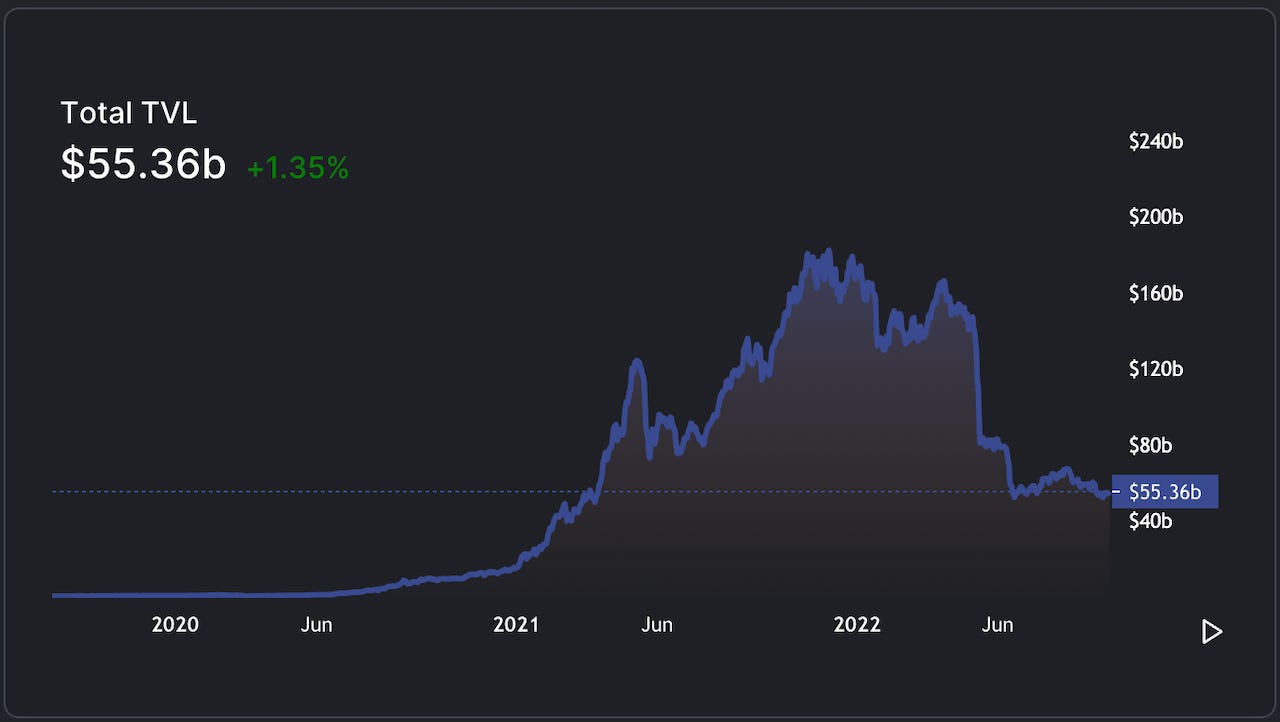

Total Value Locked: $55.36B (down 0.3% since last week)

DeFi Market Cap: $45.05B (unchanged)

DEX Weekly Volume: $9B (unchanged)

Bonus Reads

[yyctrader – The Defiant] – Cosmos Poised To Revamp ATOM Tokenomics

[Timothy Craig – Crypto Briefing] – Stablecoin Reserves Must Be “Publicly Transparent”: Jerome Powell

[Andrew Hayward and Tom Farren – Decrypt] – Facebook, Instagram Users in US Can Now Share Ethereum, Flow and Polygon NFTs

[Mat Di Salvo – Decrypt] – ETHW Surges as Binance Launches Ethereum Proof-of-Work Mining Pool