This Week In DeFi – September 23

This week, US Congress looks to ban certain algo stablecoins, Nomura launches a crypto VC unit and FV Bank accepts direct deposits in USDC.

To the DeFi community,

This week, members of US Congress are working on legislation that may ban “endogenously collateralized stablecoins” for two years, according to a report by Bloomberg news. Infringement could be punishable by up to five years in prison and a $1 million fine.

The representatives are seeking to stop the creation of stablecoins that are backed solely by the value of another asset also issued by the same entity – motivated by the collapse of Terra and TerraUSD earlier this year.

The US Treasury department will be conducting a study to examine such stablecoins, while the proposed ban is in effect.

Nomura, one of Japan’s largest investment banks, has launched a venture capital unit to invest in crypto, with a focus on DeFi, CeFi, Web3 and blockchain infrastructure.

The VC unit will be called Laser Venture Capital, operating under Nomura’s new digital asset business Laser Digital. The bank also seeks to launch secondary trading and investor products.

Digital Bank FV Bank has enabled direct deposits of USDC for account holders. Deposits of the stablecoin will be converted automatically into US dollars, providing a frictionless banking experience bridging the DeFi and traditional financial world.

The solution will make it easy for FV Bank users to invoice global clients in USDC, for rapid international settlements.

MakerDAO governance has voted in favor of adding GnosisDAO (GNO) as a collateral token for DAI, with 77% of voting power in favor of the addition. Risk, technical and oracle assessments are still yet to be carried out, which will be followed by a final vote to actually add GNO as a collateral type.

GnosisDAO has expressed plans to mint 30 million DAI using GNO from its treasury as collateral, if it is added.

Stablecoins have taken the majority of this week’s spotlight, with a mixture of both good and bad news for the asset category.

USDC has seen some tremendous adoption and acceptance over the last week, being added as a supported asset on trading app giant, Robinhood – the first stablecoin on the platform.

Digital Bank, FV Bank, has also created a significant bridge for its customers between the crypto and traditional financial worlds, with USDC taking center stage and being accepted for direct deposits.

Algorithmic stablecoins, on the other hand, are being dealt another blow. This time, US Congress is taking action to ban stablecoins backed solely by an asset from the same issuer – a move that has the potential to take out a few major decentralized stables. This may also may push back launch dates for pending stablecoin releases from Aave (GHO) and Curve (crvUSD), as the more clarity is sought for the details and likelihood of the legislation.

On the other hand, institutions have embraced DeFi and crypto across the world this week, as Japanese investment banking giant Nomura begins to invest in the space, also accompanied by SoftBank, Deutsche Telekom and Nasdaq.

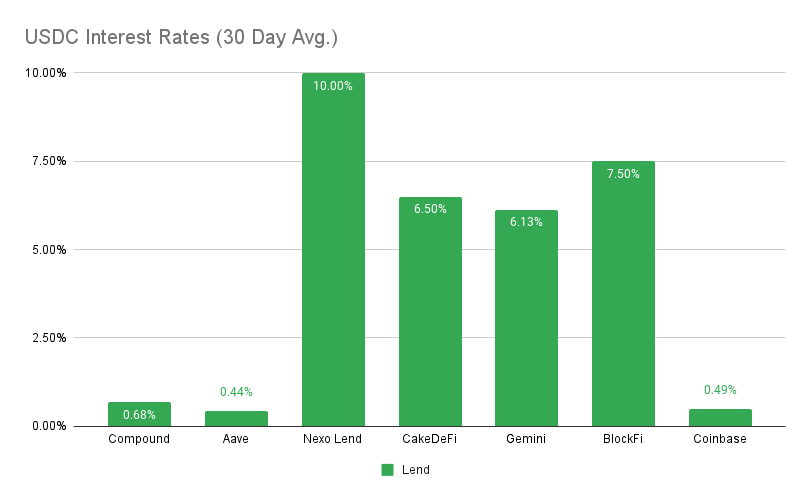

Interest Rates

DAI

Highest Yields: Nexo Lend at 10% APY, BlockFi at 6.38% APY

MakerDAO Updates

DAI Savings Rate: 0.01%

Base Fee: 0.00%

ETH Stability Fee: 0.50%

USDC Stability Fee: 0.00%

WBTC Stability Fee: 0.75

USDC

Highest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY

Top Stories

Nasdaq reportedly preparing crypto custody services for institutions

Robinhood Adds USDC to Crypto Listings

Fed Hikes Rates by Another 75 Basis Points

SoftBank, Deutsche Telekom Back $300M Fund With Web3 Component

Stat Box

Total Value Locked: $55.53B (up 1.7% since last week)

DeFi Market Cap: $45.04B (down 1.7%)

DEX Weekly Volume: $9B (down 25%)

Bonus Reads

[Michael McSweeney – The Block] – CFTC files lawsuit against decentralized autonomous organization

[Brandy Betz – CoinDesk] – A16z Leads $51.5M Round for Web3 Fraud Protection Startup Sardine

[Owen Fernau – The Defiant] – Newly-Formed Uniswap Foundation Awards First Grants

[James Hunt – The Block] – Cardano’s Vasil upgrade triggers after a 3-month delay