This Week In DeFi – October 28

This week, MakerDAO approves up to $1.6 billion in USDC deposits into Coinbase Custody, FTX looks to launch its own stablecoin and zkSync drops zkSync 2.0 with smart contracts.

To the DeFi community,

This week, MakerDAO has passed a proposal which could see the protocol move up to $1.6 billion in USDC to Coinbase Custody, for a 1.5% return. Maker has already joined Coinbase’s institutional rewards pilot program for the move.

A second proposal has also approved a $500 million USDC loan to Coinbase, collateralized with ETH and BTC. The loan will generate a variable interest rate of 4.5% to 6%, with monthly payments.

FTX CEO Sam Bankman-Fried revealed in an interview that the exchange is very likely to create a stablecoin – and is currently exploring a suitable partner for the move. He also hinted that an announcement is coming soon.

Currently, FTX offers margin trading against a basket of five stablecoins, including competitor Binance’s BUSD.

Layer-2 scaling network zkSync is set to launch version 2.0 of its platform today, opening the floodgates for developers to create and deploy smart contracts. A governance token may also be on the way.

zkSync is a ZK-Rollup platform which reduces transaction fees and increases throughput, while allowing code to be written in Ethereum’s Solidity programming language. The previous version of the network, zkSync 1.0, only allowed the simple transfer of tokens between wallets.

Lending protocol Compound has paused markets for four assets on its platform, following a governance proposal aiming to protect user funds. The move – which will halt deposits and loans on the affected assets – is designed to prevent price manipulation attacks in current low-liquidity conditions.

The four affected markets are 0x (ZRX), Basic Attention Token (BAT), Maker (MKR) and Yearn Finance (YFI).

FTX may be the latest major party to jump into the stablecoin warzone, as CEO Sam Bankman-Fried alludes to the exchange launching its own stablecoin. The move would place the new token as the closest competition for Binance’s BUSD, which has steadily gained market share after “basketing” other stablecoins on the Binance exchange.

On the other side of the stablecoin market, Maker ventures further into the “Ce-Fi” world, passing proposals to use Coinbase custody and loan services to earn a return on USDC collateral backing DAI – a controversial move in the eyes of some.

Zooming out, the wider DeFi market appears to still be in a slight slump, as users and traders await long-anticipated airdrops and development updates on major projects, such as the expected Arbitrum governance token release. Low liquidity leading to halted Compound markets isn’t the best sign, however market volatility has picked up ever so slightly.

Whichever upcoming project decides to make a push for trading activity and wider adoption may just be able to take the attention of the whole ecosystem during this quiet time – but who will make the first move?

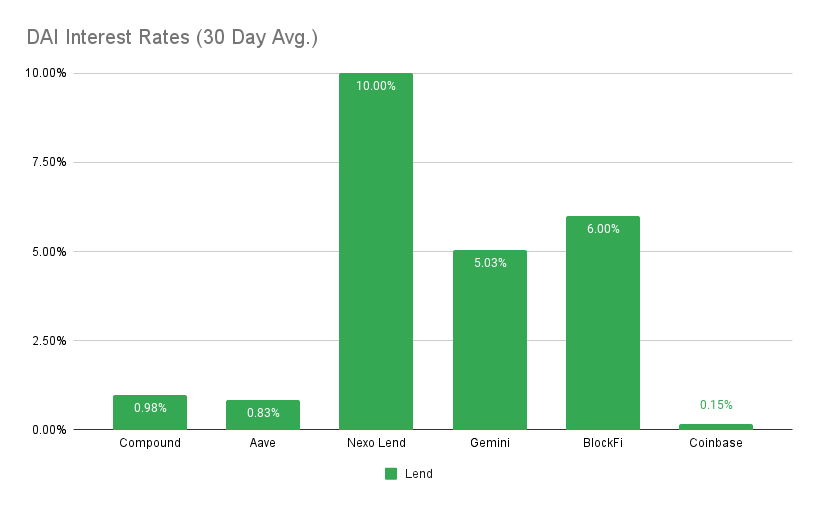

Interest Rates

DAI

Highest Yields: Nexo Lend at 10% APY, BlockFi at 6% APY

MakerDAO Updates

DAI Savings Rate: 0.01%

Base Fee: 0.00%

ETH Stability Fee: 0.50%

USDC Stability Fee: 0.00%

WBTC Stability Fee: 0.75

USDC

Highest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY

Top Stories

UK May Soon Recognize Cryptoassets As Financial Instruments

Apple's New NFT Policy Sparks Controversy

Google Introduces Cloud-Based Blockchain Node Service for Ethereum

Inflation-pegged ‘flatcoin’ launches testnet to track the cost of living

Stat Box

Total Value Locked: $54.1B (up 4.4% since last week)

DeFi Market Cap: $45.75B (up 7.3%)

DEX Weekly Volume: $7B (up 17%)

Bonus Reads

[Vishal Chawla – The Block] – Near Foundation spends $40 million to replace USN stablecoin's 'collateral gap'

[Osato Avan-Nomayo – The Block] – Ribbon Finance mulls new DeFi lending pools for institutional borrowers

[Andrew Hayward – Decrypt] – Teleport Creators Raise $9M to Build Decentralized Uber Rival on Solana

[Mike Dalton – Crypto Briefing] – Twitter Introduces Tweet Tiles for NFTs