This Week In DeFi – November 11

This week, FTX and Alameda Research go under, BlockFi halts customer withdrawals, Solana takes a huge hit and Wintermute's Bebop DEX launches on Polygon.

To the DeFi community,

This week, FTX and Alameda Research stole all of the headlines with their collapse. The entire event began with last week’s revelations of Alameda’s highly-illiquid holdings and collateral, leading to Binance de-risking and dumping FTX’s exchange token, FTT.

It was all downhill from there, as insolvency rumors surfaced and became a self-fulfilling prophecy. Matters were made worse as FTX customer funds were used in an attempt to prop-up Alameda’s losses, to no avail.

Binance expressed interest in saving the exchange via an acquisition, but abandoned the potential deal shortly after reviewing the company’s financials.

The price of FTT cratered as exchange customers and investors headed for the exits, leaving the exchange with an $8 billion shortfall. FTX has since filed for Chapter 11 bankruptcy.

The contagion from the FTX implosion is beginning to precipitate, as many major players reveal losses from the event. BlockFi appears to be one of the more-affected parties, announcing that they will be suspending withdrawals until the dust settles.

The move paints a dangerous picture, following in the footsteps of several other troubled lending platforms and exchanges that ultimately went bankrupt earlier this year – most of which resulted from the Terra and Three Arrows Capital collapses.

Solana has been the blockchain network most affected by the FTX collapse, seeing massive losses in terms of both SOL token price and total value locked (TVL) in the ecosystem.

FTX and Alameda Research were highly involved and invested in the Solana ecosystem, owning a large share of SOL and other prominent tokens based on the blockchain.

Before the drama went down, Wintermute-backed decentralized exchange (DEX) Bebop went live on Polygon. The DEX allows users to trade multiple assets in a single transaction, cutting the gas fees and manual effort associated with making several transactions.

Bebop was previously only running on Ethereum mainnet.

Yet another major centralized crypto entity has gone down, as FTX and Alameda Research collapse in a heart-breaking fashion – just as the ecosystem was appearing to find its footing after a tough year of action.

The blatant misappropriation of customer funds and sheer magnitude of the implosion has already pushed regulators to step in and increase oversight in the sector, which may have some significant long-term impacts.

Once again, however, the collapsed entities were centralized finance operating within the crypto sector. It appears that human error may have significantly surpassed the risks in smart contracts and blockchain code – further solidifying the case for functioning DeFi systems to replace those centralized entities we rely on so heavily.

The contagion from the FTX appears to still be precipitating, so the coming week will be the one to watch for more casualties.

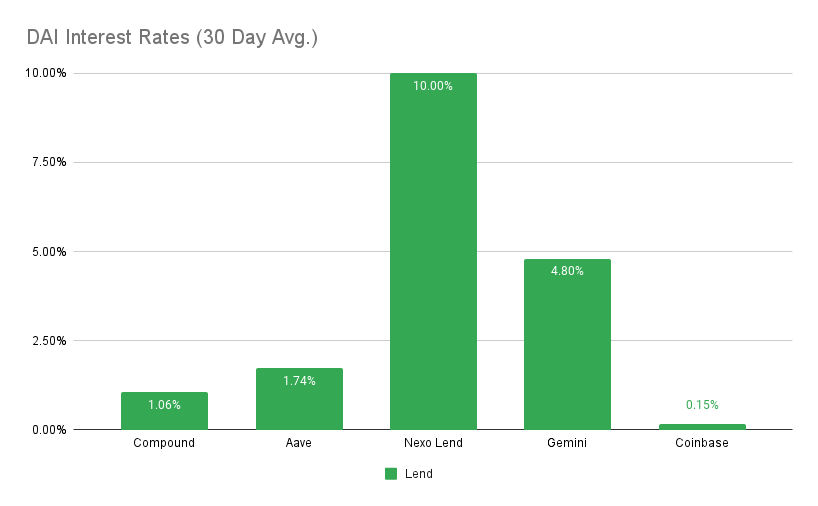

Interest Rates

DAI

Highest Yields: Nexo Lend at 10% APY, Gemini at 4.95% APY

MakerDAO Updates

DAI Savings Rate: 0.01%

Base Fee: 0.00%

ETH Stability Fee: 0.50%

USDC Stability Fee: 0.00%

WBTC Stability Fee: 0.75

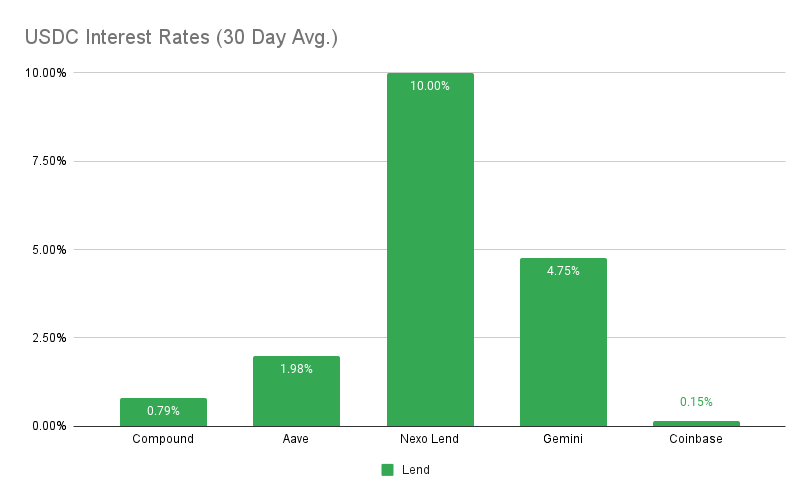

USDC

Highest Yields: Nexo Lend at 10% APY, BlockFi at 5.43% APY

Top Stories

White House is monitoring FTX implosion, calls for more crypto regulation

European G20 leaders call for urgent regulation of 'crypto conglomerates'

After prices rise less than expected, markets soar on hopes of lower inflation

LBRY Token Ruled a Security in Case Brought by SEC

Stat Box

Total Value Locked: $45.25B (down 18% since last week)

DeFi Market Cap: $39.73B (down 17%)

DEX Weekly Volume: $28B (up 155%)

Bonus Reads

[Tim Copeland – The Block] – Tether freezes 46.3 million USDT owned by FTX at request of law enforcement

[Aleksandar Gilbert – The Defiant] – Polygon Working to Become ‘True Layer 2’

[Tarang Khaitan – The Defiant] – MetaMask Launches Integrated Bridge Feature

[Tom Blackstone – Cointelegraph] – Chainlink Labs offers Proof of Reserve service for embattled exchanges