This Week In DeFi – May 26

This week, Multichain experiences unexplained disruptions, Coinbase's Base outlines its path to Mainnet, Tornado Cash governance is exploited, and tokenized securities are trending.

To the DeFi Community,

This week, cross-chain protocol Multichain has experienced a disruption to some of its cross-chain routes, with an explanation yet to be given by the development team.

Reported issues with stuck transactions have been ongoing since May 21, and Multichain has promised to compensate affected users for the inconvenience.

The continued silence from the team about the cause of the issue has prompted several key stakeholders to take action, with the Fantom Foundation withdrawing $2.4 million in liquidity of MULTI tokens from SushiSwap, while HashKey Group, moved $250,000 to a crypto exchange Gate.io, and Tron founder Justin Sun has pulled 470,000 USDD from the Multichain protocol.

Unverified rumors on Twitter suggest that the core leadership team may have been arrested in China. Multichain is home to over $1.53 billion in liquidity.

Coinbase's Base network, a Layer-2 scaling solution for Ethereum, has outlined a roadmap for the launch of its mainnet – although specific dates have not been provided.

The network, which uses Optimistic Rollup technology, has already fulfilled two out of five criteria necessary for the launch. This included the successful performance of the Regolith hard fork, and an infrastructure review with the OP Labs team.

The third criterion involves upgrading the network to Bedrock, a change that is scheduled for June 6 in Optimism's roadmap. The last two criteria include completing internal and external audits and demonstrating testnet stability.

Base has garnered plenty of attention with speculation surrounding the apps that will be built on the network. However, concerns have been raised about the network's centralization and its impact on user privacy.

Privacy mixer Tornado Cash was hacked this week, in an exploit which gave majority control of its DAO to the attacker.

A malicious governance upgrade approved on May 20 snuck in an extra function that gave the attacker 1.2 million votes, and as a result access to some protocol funds, including the treasury. A total of 483,000 TORN was taken from the protocol, with the majority being sold for Ether. 100,000 TORN remains in their control.

Tornado Cash is still functional, with the attacker unable to access pooled funds on Ethereum – even sending 100 to the router themself.

Interestingly, the attacker submitted their own proposal to Tornado Cash governance to revert all of their own malicious changes to the protocol.

https://twitter.com/samczsun/status/1660012956632104960

The security tokenization trend is gaining momentum, as several firms have created ERC-20 tokens representing securities such as government bonds and exchange-traded funds (ETFs) on blockchain platforms.

Companies like Matrixport, Backed Finance, Ondo, and Franklin Templeton have issued tokenized securities on platforms like Ethereum, Polygon, and Gnosis Chain. Ondo and MatrixDock dominate the market with offerings of short-term U.S. government bonds.

Tokenized securities offer advantages such as lower fees, faster settlement, and integration with existing business models. Regulatory clarity and interoperability with decentralized finance (DeFi) platforms are seen as important factors for the continued growth of tokenized securities.

The total market cap of tokenized securities across six major platforms recently reached over $220 million.

Things are moving along in DeFi this week – with a mixture of battle-testing and innovation.

Unfortunately Tornado Cash can’t seem to catch a break, however hopefully the attacker will return control of the protocol and give us a valuable lesson for governance improvements. Things are yet to be resolved with Multichain, however it is fortunate that the protocol is just seeing some roadblocks, rather than any loss of funds.

New Layer-2 progress and security tokens are providing some new excitement, as transactions become cheaper (and quicker), along with some new financial instruments to play with on-chain. Subject to restrictions via regulation, tokenized securities have been in the works for a long time in DeFi – and we’re finally seeing some real adoption and use of these tools.

We also have a potential larger-scale adoption of stablecoins according to leaked EU plans, with a possible lowering of barriers for banks to start incorporating stablecoin usage into their everyday business.

DeFi is slowly, but surely, integrating more tightly with traditional finance and we hope this trend will continue.

Our usual CeFi stories also continue to develop, as DCG misses its deadline for payment of a huge $630 million owed to Gemini – which will now move to a period of forebearance to enable DCG to fulfil its obligations without going under. Hopefully, the payment can be resolved so that affected users can see the return of some (if not most) of their funds.

Celsius assets may have a new owner, as the Farenheit consortium’s bid wins at auction. These assets, once worth over $2 billion could soon be in new hands and see some eventual resolutions.

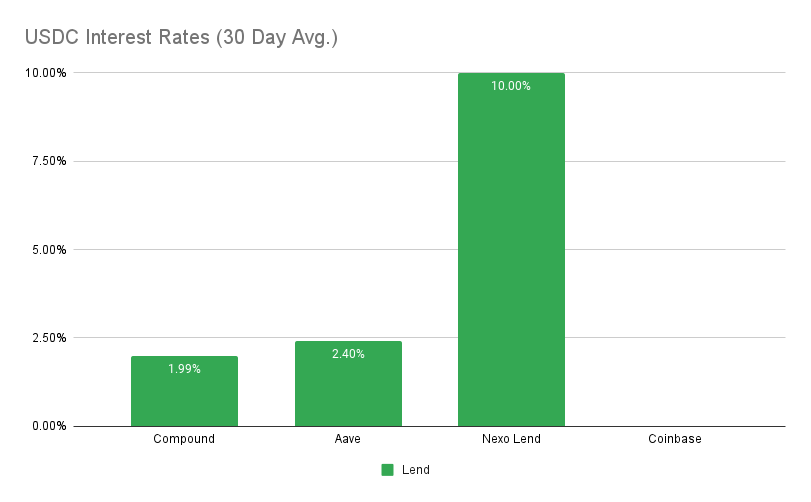

Interest Rates

DAI

Highest Yields: Nexo Lend at 10% APY, Aave at 2.0% APY

MakerDAO Updates

DAI Savings Rate: 1.00%

Base Fee: 0.00%

ETH Stability Fee: 0.50%

USDC Stability Fee: 0.00%

WBTC Stability Fee: 0.75%

USDC

Highest Yields: Nexo Lend at 10% APY, Aave at 2.4% APY

Top Stories

DCG misses $630 million payment due earlier this month, says Gemini

EU Banks Could Access Stablecoins More Easily Under Leaked Plans

Fahrenheit Wins Bid to Acquire Assets of Insolvent Crypto Lender Celsius

Ledger CEO: Government subpoena to access user funds is the 'only concern'

Stat Box

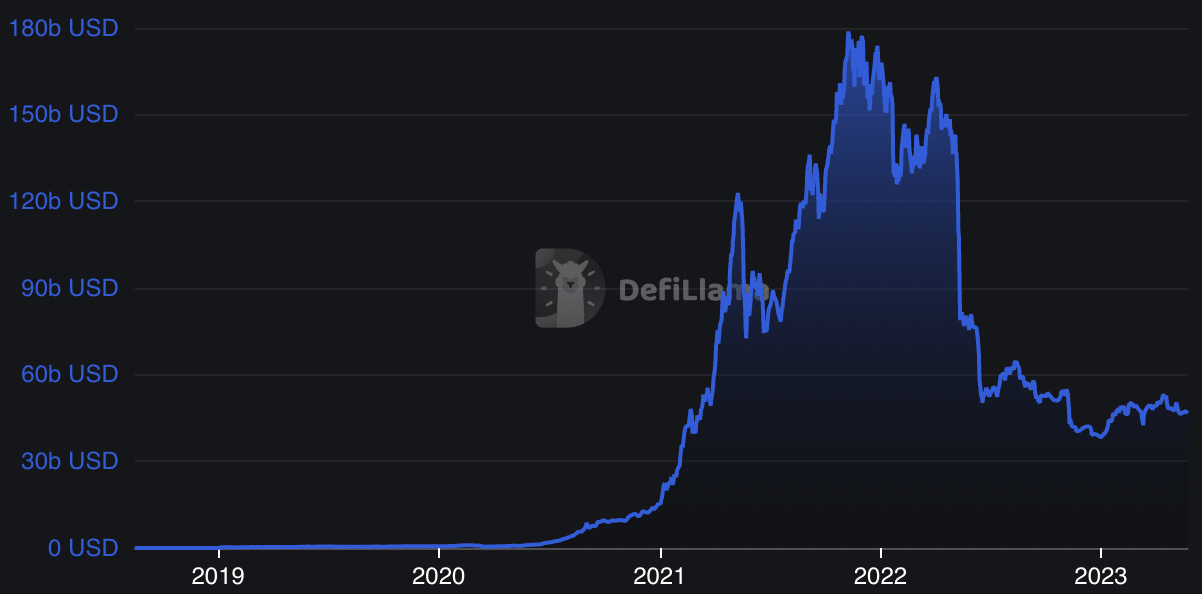

Total Value Locked: $46.65B (up 0.9% since last week)

DeFi Market Cap: $46.26B (down 0.6%)

DEX Weekly Volume: $7.39B (up 7.6%)

Bonus Reads

[Shaurya Malwa – CoinDesk] – BNB Chain Expected to Undergo ‘Luban’ Upgrade in June. Here’s all You Need to Know

[Vishal Chawla – The Block] – Synthetix founder wants to buyback and burn millions of SNX tokens

[Ezra Regeurra – Cointelegraph] – Circle launches euro-based stablecoin on Avalanche blockchain

[Yogita Khatri – The Block] – Binance enters NFT lending space, starting with ETH loans