This Week In DeFi – March 17

This week, USDC loses and regains its dollar peg, Arbitrum finally announces a token and airdrop, Ethereum sets a target date for withdrawals and Euler Finance is hacked for $200M.

To the DeFi community,

This week, Decentralized exchanges saw record-highs in trading volume last weekend, primarily sparked by panic-trading caused by a de-pegging of USD Coin (USDC).

The de-pegging of the renowned stablecoin was triggered by news of $3 billion of its reserves being trapped in Silicon Valley Bank, which collapsed.

Despite the crisis, Circle (the company that issues USDC) confirmed that every USDC token remained backed by one U.S. dollar. Traders' confidence in USDC was demonstrated by a surge in on-chain leveraged positions.

The highly-popular Ethereum Layer-2 scaling platform is at last distributing its governance token ARB to its community members, on March 23.

ARB will enable the community to control the governance of the Arbitrum One and Nova networks through a self-executing DAO. The airdrop will represent 12.75% of the total supply and will be handed to those who have used the network over the last year, but it will not be used for paying transaction fees.

Steven Goldfeder, CEO of Offchain Labs, the maker of Arbitrum, said the goal is to decentralize the network by giving governance power to community members who are active in the chain.

Ethereum developers have set a target date of April 12 for the completion of the full transition to a proof-of-stake network, with the Shanghai upgrade – which will finally enable staked ETH withdrawals.

The target date marks a slight delay from the developers' initial target for this month. Validators have had their funds locked up since December 2020, and will be able to decide after April 12 what they want to do with their stake.

While the last testnet hard fork experienced low participation rates, Ethereum developers are confident that the mainnet upgrade will not be affected.

DeFi lending protocol Euler Finance threatened its recent exploiter with legal consequences, if they did not return 90% of the stolen funds within 24 hours.

The exploiter stole $196m from the protocol on March 13 and has not returned the funds before the deadline, leading the Euler Foundation to offer a $1 million reward for any information leading to the identification and arrest of the attacker.

Events over the last week took a fascinating turn, as failure in the traditional banking sector led to turbulence in the crypto markets – rather than the other way around.

Silicon Valley Bank collapsed, taking $3 billion of USDC’s reserves along with it, resulting in chaos across the DeFi world. USDC was considered to be one of the safest stablecoins around, leading to widespread shock as the token plummeted in value to as low as 81 cents on some exchanges.

Although USDC managed to successfully re-peg to the dollar, the event was just the latest example of centralized parties being a critical point of failure in crypto and DeFi. Centralized stablecoins should most likely be considered a temporary vehicle for storing value on-chain while native coins (BTC, ETH, etc.) are still reaching their saturation point, and eventual stability.

Until then, it is important to remember that centralized stablecoins are at the mercy of those in charge of managing them and their reserves, as well as regulators who are defending the traditional financial system.

Interest Rates

DAI

Highest Yields: Nexo Lend at 10% APY, Aave at 1.4% APY

MakerDAO Updates

DAI Savings Rate: 1.00%

Base Fee: 0.00%

ETH Stability Fee: 0.50%

USDC Stability Fee: 0.00%

WBTC Stability Fee: 0.75%

USDC

Highest Yields: Nexo Lend at 10% APY, Aave at 1.8% APY

Top Stories

EU Parliament Passes Bill Requiring Smart Contracts to Include Kill Switch

Voyager-Binance.US Pause Denied by Bankruptcy Judge

Polygon Labs partners with Unstoppable Domains to launch top-level domains

Uniswap officially expands exchange services to BNB Chain

Stat Box

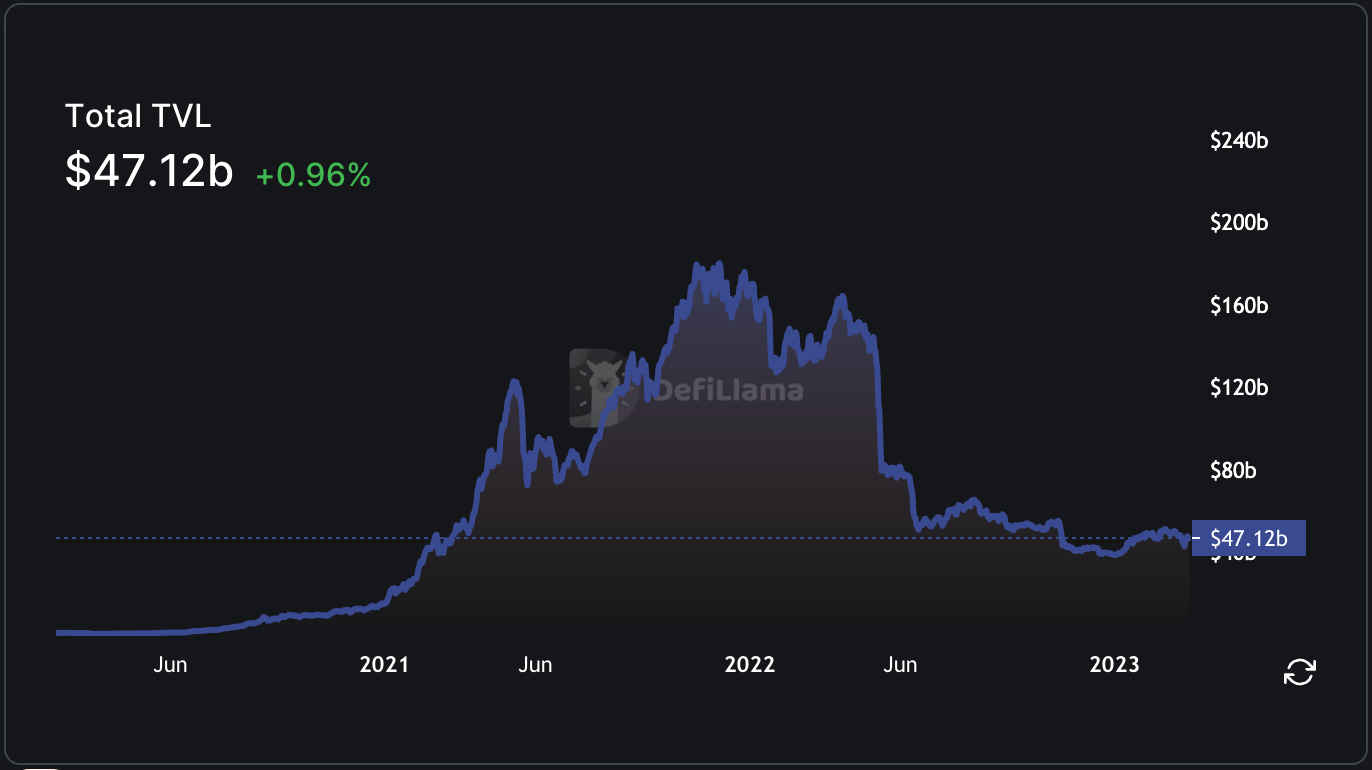

Total Value Locked: $47.12B (up 5.1% since last week)

DeFi Market Cap: $49.88B (up 14%)

DEX Weekly Volume: $47.85B (up 555%, not a typo!)

Bonus Reads

[Ian Allison – CoinDesk] – Coinbase Is Adding DeFi Apps Uniswap and Aave to Its Base Blockchain: Source

[Robert Stevens – CoinDesk] – Uniswap's NFT Platform Shows DeFi's Reluctant Acceptance of Centralization

[Aleksandar Gilbert – The Defiant] – Filecoin Launches Ethereum-compatible Smart Contracts

[Danny Nelson – CoinDesk] – Crypto Exchange Orca to Block US Traders From Website