This Week in DeFi - March 11

This week, Kyberswap on Arbitrum, Avalanche announces $290m in incentives, Cega gets $3.4m for Solana derivatives, and Wirex adds Paraswap

To the DeFi community,

This week, the Kyberswap DEX launched on Arbitrum, continuing efforts to help users avoid high fees when the Ethereum network becomes congested. Kyberswap is now available on Ethereum, Polygon, Avalanche, BSC, Fantom, and Cronos, making it one of the most widely available DEX.

The Avalanche Foundation launched the Multiverse incentive program, offering up to $290 million in AVAX to boost development of subnets, app-specific blockchain instances. The program will be supplemental to Avalanche Rush, a DeFi-focused incentive campaign rewarding developers building on Avalanche’s C-Chain.

Cega, building on Solana, announced a $4.3m seed round led by Dragonfly capital. Cega will help bring new exotic derivative products to Solana, starting with options contracts and developing more complex instruments from there.

And Wirex Wallet added native trading capabilities to their mobile wallet application by integrating Paraswap and will offer no-commission swaps on the platform. The Wirex wallet also recently added cross-chain bridging through an integration with Celer’s cBridge application.

As DeFi continues to mature, the volume of projects on specific chains as well as in aggregate may decline from high water marks set in 2020 or 2021. Leading players that developed applications we’re familiar with today like Aave or Uniswap continue to consolidate their brand recognition, and have ample war chests that allow them to continue to innovate in their original domains and beyond.

As the low hanging fruit of simple DeFi use cases is picked, incentives to try to compete in those domains decline, as existing players become the go-to providers of their respective services. Successful projects will increasingly need to rely on genuinely innovative protocols or services to attract investment and attention, and venture capital resources will have tightened up their investment criteria after having seen dozens or hundreds of similar pitches. The complexity in vision or execution for new DeFi projects may also start to require deeper knowledge of existing products and development practices, further reducing the raw number of projects attempted.

The good news is, a reduction in quantity may well be associated with an overall increase in the quality of new DeFi innovations. As crypto markets warn of another down period, we could see another quiet but mighty period of innovative development without much fanfare, not unlike the period that led up to the explosion of DeFi in the first place. Whatever happens, keep your eyes open for the next big thing - the hits keep coming, if you keep looking.

Thanks to our partner:

Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review.

Interest Rates

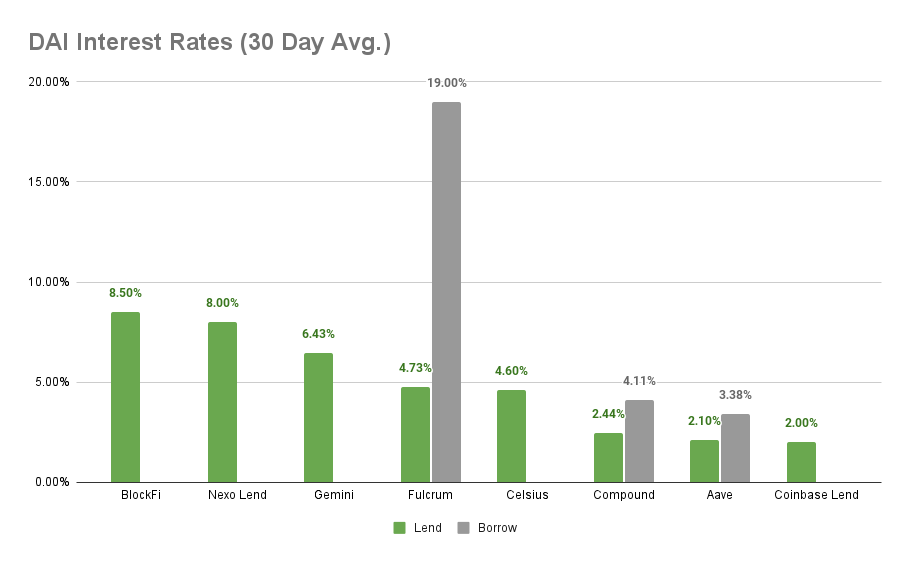

DAI

Highest Yields: BlockFi at 8.50% APY, Nexo Lend at 8.00% APY

Cheapest Loans: Aave at 3.38% APY, Compound at 4.11% APY

MakerDAO Updates

DAI Savings Rate: 0.00%

Base Fee: 0.00%

ETH Stability Fee: 2.00%

USDC Stability Fee: 0.00%

WBTC Stability Fee: 2.00%

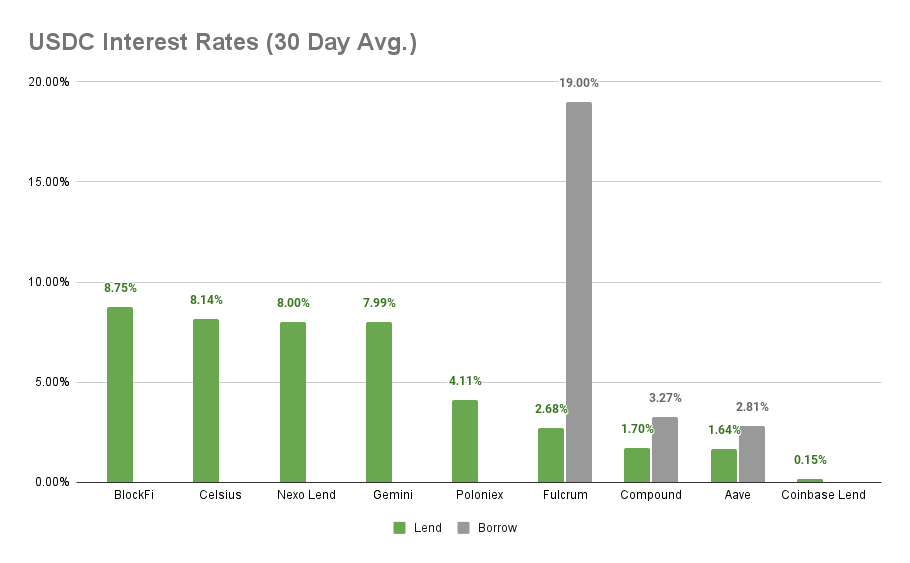

USDC

Highest Yields: BlockFi at 8.75% APY, Celsius at 8.14% APY

Cheapest Loans: Aave at 2.75% APY, at Compound at 3.27% APY

Top Stories

Biden Signs Executive Order on U.S. Crypto Strategy

Bain Capital Ventures Launches $560M Crypto-focused Fund as Ecosystem Booms

Fintech Platform Cake DeFi Creates $100M Venture Capital Arm

Stat Box

Total Value Locked: $74.4B (down -4.57% since last week)

DeFi Market Cap: $114.02B (down -3.76%)

DEX Weekly Volume: $13.65B (down -28.42%)

Bonus Reads

[Mike Dalton – Crypto Briefing] – "Responsible Development of Digital Assets": Biden's Executive Order Unpacked

[Brooks Butler – Crypto Briefing] – Stripe Gets Back Into Crypto

[Samuel Haig – The Defiant] – Call to Reduce Yield Payouts to Save Anchor Protocol Roils Terra Community

[Anthony Sassano – The Daily Gwei] – Funding Layer 2 - The Daily Gwei #453