This Week In DeFi – June 10

This week, Ethereum completed its Ropsten testnet merge, Wintermute unveiled its DEX aggregator and TronDAO decides to overcollateralize USDD

To the DeFi community,

This week Ethereum completed its Ropsten testnet merge – a test-run of the network’s most major upgrade to date. The merge will now be monitored for any inconsistencies or bugs, with some developers deploying their dApps on the testnet to assist with the process. Additional merge tests will be run on the Sepolia and Goerli testnets before the transition is finally executed on the Ethereum mainnet.

Well-known trading firm Wintermute has unveiled a new decentralized exchange aggregator called Bebop, aiming to eliminate slippage and improve user experience. Bebop will feature new features such as the ability to swap several tokens at once, enabling users to rapidly enter or exit multiple positions.

TronDAO has opted to over-collateralize its USDD stablecoin, in an effort to strengthen its long-term viability and quell comparisons to Terra’s failed UST experiment. According to TronDAO, USDD is currency 201% collateralized, with plans to maintain at least a 130% collateralization ratio. Some in the community, however, do not agree with the way this ratio has been calculated.

Chainlink has released a long-term roadmap for future token staking plans, as well as expanding its tools to two major blockchains. Solana has integrated seven different Chainlink price feeds, while Avalanche has received ChainlinkKeepers and Verifiable Random Functions (VRFs).

With the Ethereum Proof-of-Stake merge process headlining the week, all eyes are on the largest smart-contracts platform in the world right now – some news being exceedingly positive, but also some not so much. Of particular concern is staked Lido Staked Ether (stETH), i.e. tokens representing a claim on Ether (ETH) staked in the mainnet beacon chain in anticipation of the "real" merge. The stETH token is a way to provide some utility to this otherwise-immobile ETH, enabling transferability and other uses across the ecosystem.

However, a possible liquidity crunch and dive in demand for stETH may send some lending platforms (both centralized and decentralized) into a selling frenzy, in a similar manner to a traditional bank-run. At the center of the concern lies Celsius – one of the largest holders of stETH, unfortunately also in the middle of insolvency rumors. With users withdrawing their funds from the platform in a risk-averse bear market, some worry that Celsius will have to begin selling their stETH to cover those claims. Add to this a possible delay to the mainnet merge and price discovery for stETH that doesn't quite match the exact price of ETH, and we have some decently-justified worries to address.

Twitter user @Crypto_Joe10 had some valuable insights and opinions in the post above.

Thanks to our partner:

Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review.

Interest Rates

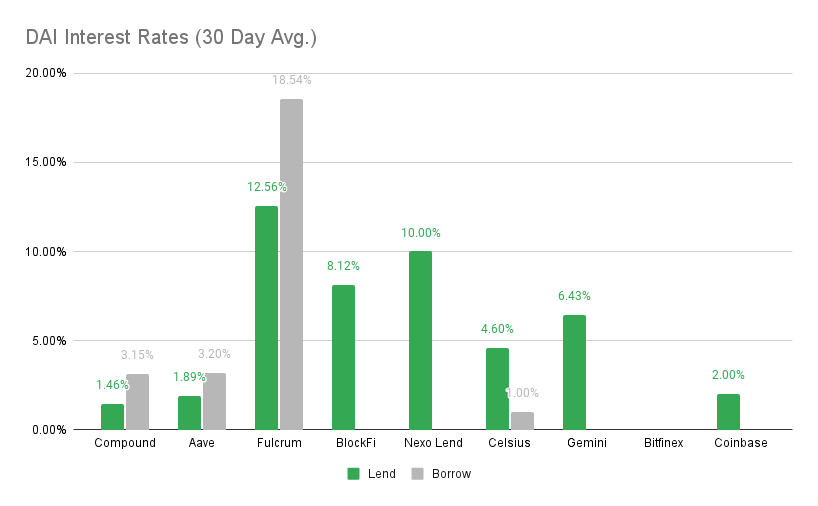

DAI

Highest Yields: Nexo Lend at 10% APY, BlockFi at 8.12% APY

Cheapest Loans: Celsius at 1%, Compound at 3.15% APY

MakerDAO Updates

DAI Savings Rate: 0.01%

Base Fee: 0.00%

ETH Stability Fee: 0.50%

USDC Stability Fee: 1.00%

WBTC Stability Fee: 0.75%

USDC

Highest Yields: Nexo Lend at 10% APY, Gemini at 7.99% APY

Cheapest Loans: Celsius at 0.10%, Compound at 2.17% APY

Top Stories

PayPal Enables Crypto Withdrawals to Non-Custodial Wallets

New York's financial regulator issues new guidance on dollar-backed stablecoins

DeFi contagion? Analysts warn of ‘Staked Ether’ de-pegging from Ethereum by 50%

Tether Launches Stablecoin on Tezos to Unlock New DeFi Products

Stat Box

Total Value Locked: $48.99B (down 10% since last week)

DeFi Market Cap: $49.3B (down 0.6%)

DEX Weekly Volume: $11B (down 8.3%)

Bonus Reads

[Vishal Chawla – The Block] – Aztec updates its Layer 2 network to introduce privacy-focused DeFi on Ethereum

[Samuel Haig – The Defiant] – The Graph Poised to Expand to Arbitrum in Layer 2 Win

[Sam Venis – The Block] – Entropy announces $25 million seed round led by Andreessen Horowitz

[Nikhilesh De – CoinDesk] – SEC Investigating Company Behind TerraUSD Stablecoin: Report