This Week In DeFi – January 13

This week, ConsenSys launches their zkEVM scaling platform testnet, Ondo Finance tokenizes US treasuries and bonds, Yearn makes vault creation permissionless, and Nexo gets raided in Bulgaria.

To the DeFi community,

This week, Blockchain infrastructure firm ConsenSys has launched a private beta testnet for zkEVM – a new scaling and privacy technology for Ethereum.

The testnet aims to explore the technology's potential to improve Ethereum's speed and transaction costs by over 100 times. ZkEVM allows developers to build applications using the same tools and coding language they are familiar with on Ethereum, but without needing to learn the cryptography and math required for zero-knowledge coding.

The testnet has received over 150,000 applications since December, and participants can bridge assets between the Goerli testnet and zkEVM to test smart contracts, dapps, infrastructure, and wallets.

Ondo Finance has launched tokenized versions of US treasuries and bonds, which allow stablecoin holders to invest in bonds and treasuries.

The offerings include the US Government Bond Fund, Short-Term Investment Grade Bond Fund, and High Yield Corporate Bond Fund. These tokenized funds are transferable on-chain, and Ondo Finance earns a 0.15% annual management fee through these bonds.

The company previously raised $10 million in a public token sale in July 2022 and $20 million in a Series A funding round led by Peter Thiel's investment fund in April 2022.

Yearn Finance will allow users to create their own vaults to accrue yield and deposit proceeds to earn even more token rewards, charging 10% as performance fees.

Until now, users have been limited to vaults created by Yearn contributors and developers – however, the “permissionless vault factory,” will let anyone create their own strategies and offer them on Yearn, where other interested users can deposit their own tokens and earn yields.

Initially, users will be able to make vaults only for Curve Finance liquidity tokens, using veCRV.

CeFi crypto lender Nexo is facing pressure from regulators as its offices were reportedly raided as part of an international investigation.

The operation, which began a few months ago, is targeting a large-scale financial criminal scheme involving money laundering and violations of international sanctions against Russia, and Nexo is alleged to be involved.

Nexo has denied any wrongdoing and said it has been compliant with global crypto regulations and has enforced strict Anti-Money Laundering and Know Your Customer policies.

New scaling platforms for Ethereum make headlines this week, as ConsenSys releases its zero-knowledge Ethereum Virtual Machine (zkEVM) platform in private beta. BitDAO has also launched a testnet for “Mantle”, its very own Layer-2 scaling network. BitDAO claims to have 37,000 developers already signed on to test their apps on the new chain (link in “Bonus Reads”).

Tokenization has reached a new frontier, as the Peter Thiel-backed Ondo Finance puts US treasuries and bonds on the blockchain. The innovation sees an interesting integration of low-risk assets into a high-risk crypto ecosystem, however the asset could be argued to be very similar to a traditional stablecoin.

Of course, “CeFi” continues to string together problems in crypto, as DCG is revealed to owe creditors more then $3 billion, Nexo gets raided by authorities and the latest stablecoin mishap surfaces in BUSD – revealed to have been insufficiently backed from 2020-2021.

Although the negative headlines surrounding centralized parties in DeFi keep plaguing the space, it appears that both development and token prices are now making keener progress, at long last.

Interest Rates

DAI

Highest Yields: Nexo Lend at 10% APY, Aave at 1.3% APY

MakerDAO Updates

DAI Savings Rate: 1.00%

Base Fee: 0.00%

ETH Stability Fee: 0.50%

USDC Stability Fee: 0.00%

WBTC Stability Fee: 0.75%

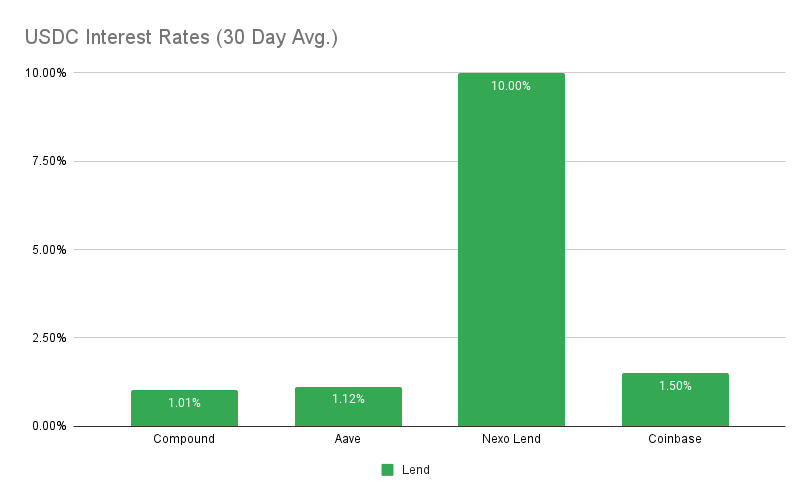

USDC

Highest Yields: Nexo Lend at 10% APY, Coinbase at 1.5% APY

Top Stories

DCG owes creditors over $3B, considering $500M VC portfolio sale

Binance Admits Lapse In Maintaining Stablecoin Reserves

Apple and the Metaverse: Everything We Know So Far

Ripple Holders Receive Flare Airdrop Two Years After Snapshot

Stat Box

Total Value Locked: $42.51B (up 7.5% since last week)

DeFi Market Cap: $39.76B (up 13%)

DEX Weekly Volume: $8.20B (up 58%)

Bonus Reads

[Osato Avan-Nomayo – The Block] – BitDAO launches testnet for Ethereum Layer 2 network Mantle

[Vishal Chawla – The Block] – Lens Protocol lets creators issue token-gated content

[Aleksandar Gilbert – The Defiant] – Avalanche and Amazon Ink Partnership to Boost Subnet Deployment

[Cam Thompson – CoinDesk] – Unstoppable Domains and Ready Player Me Team Up to Create Interoperable Metaverse Identities