This Week In DeFi – December 30

This week, Alameda Research addresses continue to engage in shady behavior, 1inch releases its "Fusion" upgrade and Stacks looks to bring smart contract functionality to Bitcoin with sBTC.

To the DeFi community,

This week, 30 crypto addresses linked to Alameda Research have become active after 4 weeks of inactivity, swapping and mixing over $1.7 million worth of funds.

Crypto forensic group Arkham has tracked the tokens, showing that they were distributed to smaller wallets and then mixed through services such as ChangeNOW and Fixedfloat.

The movement of funds by the addresses have raised suspicions among the community, especially with the timing coinciding almost perfectly with Sam Bankman-Fried’s release on bail.

Decentralized exchange aggregator, 1inch, has released its “Fusion” protocol upgrade, which offers users the ability to place custom swap orders at specific prices, without having to pay gas fees.

The upgrade also implements measures intended to protect users against front-running via maximum extractable value (MEV) bots.

In addition, the 1inch network’s governance and tokenomics has been upgraded to allow $1INCH staking for periods from one month to two years. Stakers receive “Unicorn Power”, which can be used to participate in governance, or delegated to other users or “resolvers”.

Existing smart contract platform, Stacks, is looking to rope Bitcoin directly into smart contracts with a new digital asset called Stacks Bitcoin (sBTC). The asset was revealed in a new whitepaper, which explains how sBTC, pegged 1:1 with Bitcoin, can be used to create smart contracts on Stacks, but also be readily converted back to Bitcoin.

The system is completely trustless and is powered by both sBTC and Stacks’ native token, STX. The concept will be formalized under Stacks Improvement Proposal (SIP ) 21, with an estimated delivery date of 8-9 months.

2022 has been a highly important year for DeFi, albeit a very difficult one for all those involved. The year has seen several high-profile, innovative DeFi ideas and implementations run their full course – some that stood the test of time, and others that ended in disaster.

Despite all of the losses and tears, these “experiments” have provided us with a crash-course in some of the building blocks and features of the future financial system. This includes a thorough understanding of what does not work, what does work, and what must be improved upon in the future.

In 2023, we can expect a clearer, more robust and more resilient iteration of decentralized finance that will carry us into the next phase of development. From our lessons, we have seen that we must further reduce centralized points of possible failure. We also need to ensure that smart contracts cover all bases, making no assumptions about users acting in good faith.

Although the next year will be accompanied by its own share of lessons, stress-tests and challenges, one thing is for sure: DeFi will continue to develop, grow, and make profound changes to the financial world as we know it.

Participate responsibly, manage your risks, and enjoy the great DeFi experiment for what it is – we are all an important part of history.

See you all in 2023!

Interest Rates

DAI

Highest Yields: Nexo Lend at 10% APY, Aave at 1.2% APY

MakerDAO Updates

DAI Savings Rate: 0.01%

Base Fee: 0.00%

ETH Stability Fee: 0.50%

USDC Stability Fee: 0.00%

WBTC Stability Fee: 0.75%

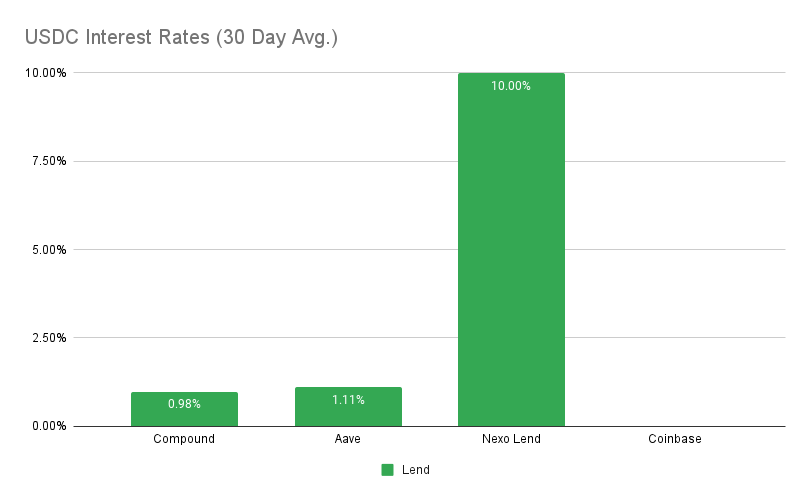

USDC

Highest Yields: Nexo Lend at 10% APY, Aave at 1.1% APY

Top Stories

Celsius looks to extend deadline for customers to file claims

MicroStrategy to offer Bitcoin Lightning solutions in 2023

Gemini Sued Over Interest-Earning Product

Solana Tokens Continue Steep Slide While Major Cryptos Stay Flat

Stat Box

Total Value Locked: $38.9B (down 2.0% since last week)

DeFi Market Cap: $34.2B (down 3.0%)

DEX Weekly Volume: $5.44B (down 14%)

Bonus Reads

[Sheldon Reback – CoinDesk] – Defrost Finance Says Hacked Funds Have Been Returned

[Tom Blackstone – Cointelegraph] – Vader will shut down stablecoin USDV, cannot find a ‘breakthrough’

[Jason Nelson – Decrypt] – Mango Markets Attacker Avraham Eisenberg Arrested, Charged With 'Market-Manipulation Offenses'