This Week In DeFi – December 2

This week, BlockFi files for bankruptcy protection, Uniswap launches its NFT marketplace aggregator, Telegram announces a DEX and wallet, and Apple tries to extort gas fees from Coinbase Wallet.

To the DeFi community,

This week, crypto lender BlockFi has filed for Chapter 11 bankruptcy protection. The firm's bankruptcy petition claims that it has over 100,000 creditors and assets and liabilities between $1 billion and $10 billion.

The largest creditor is Ankura Trust Company, which has an unsecured claim of around $729 million. Other named creditors are FTX US and the Securities and Exchange Commission, with unsecured claims of $275 million and $30 million respectively.

BlockFi has $256.9 million in cash on hand which is expected to provide sufficient liquidity to support operations during the restructuring process.

Uniswap Labs has officially launched its new NFT marketplace aggregator, bringing together NFTs for sale on OpenSea, X2Y2, LooksRare, Sudoswap, Larva Labs, X2Y2, Foundation and NFT20.

Developers have been working on the product since June, when it purchased NFT aggregator Genie as part of expansion efforts to include NFTs and ERC-20 tokens among its products.

The launch comes with some $5 million worth of USDC airdrops for eligible historical Genie users.

Telegram CEO Pavel Durov has announced that the popular messaging platform will build a decentralized exchange and non-custodial wallets that could reach millions of users.

The statement is the first confirmation of Telegram's direct involvement in integrating TON blockchain into its messenger app.

Telegram has also recently successfully sold $50 million in usernames for its platform via its blockchain-based auction platform, Fragment.

Apple has blocked the latest version of Coinbase Wallet on iOS, demanding that the gas fees associated with token transfers be paid via its in-app purchase system – a rule that intends to enable Apple to take a 30% cut of those fees.

Due to the fact that blockchain gas fees are completely incompatible with Apple’s in-app purchase system, Coinbase Wallet has no choice but to disable the feature to remain in the App Store.

This is likely to be a blow to NFT use within iOS-based web3 applications.

Centralized parties once again dominate DeFi news this week, with a variety of impacts from notable entities.

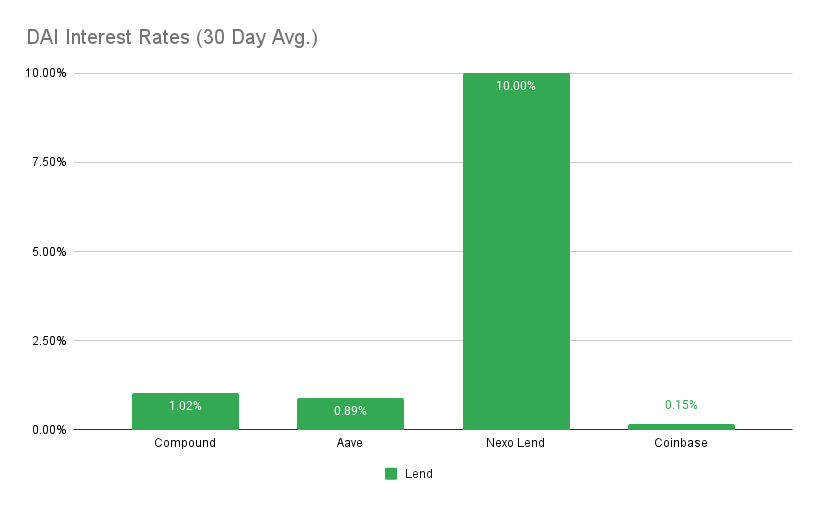

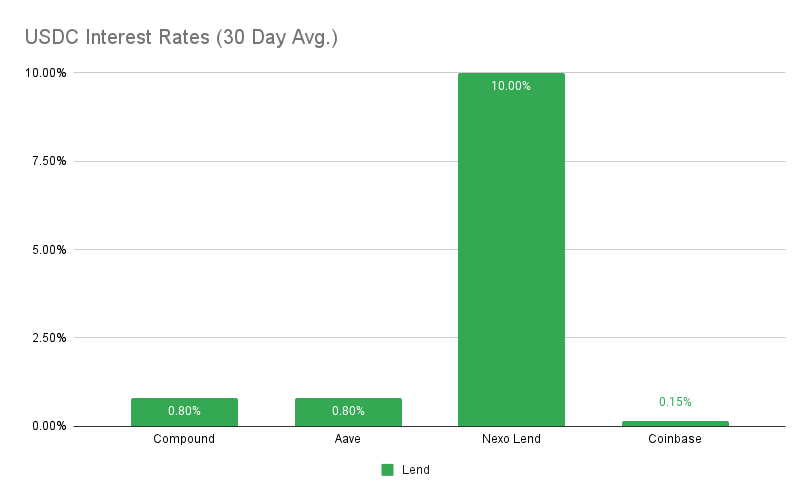

Still lingering over our heads is FTX and its contagion, with BlockFi becoming the latest confirmed casualty. The firm was one of the last major centralized entities offering interest payments on crypto deposits, with only Nexo and Coinbase remaining. Nexo may draw red flags for some, with its consistently high annual returns of 10% on stablecoins – in comparison to just a mere 1% or so on decentralized platforms.

‘FTX itself may soon be probed by the Department of Justice – an inquisition that may appear to be well overdue for some, who still see founder and ex-CEO Sam Bankman-Fried unpunished for alleged fraud.

Apple inflicting its somewhat-extortive policies on the DeFi world, this time seeking a portion of gas fees from Coinbase Wallet NFT transfers on iOS. Whether or not the policy remains in place may have a strong and lasting impact on the viability of many web3 iOS apps.

One positive story that has arisen is Russia’s Sberbank making Ethereum and MetaMask integrations with its own proprietary blockchain platform, illustrating an embrace of new technology by the traditional finance sector. The integration will make it easy to deploy smart contracts on both the private platform and the public Ethereum blockchain.

On the true DeFi side, we are witnessing a significant de-risking movement by lending platforms as they modify parameters in a low-liquidity market.

Compound is placing borrowing caps on 10 assets, while Aave has rushed to freeze lending markets for more than a week to prevent exploits. The move appears to have been sparked by the recent market manipulation of Curve’s CRV, which left Aave with seven figures of bad debt.

Interest Rates

DAI

Highest Yields: Nexo Lend at 10% APY, Compound at 1.04% APY

MakerDAO Updates

DAI Savings Rate: 0.01%

Base Fee: 0.00%

ETH Stability Fee: 0.50%

USDC Stability Fee: 0.00%

WBTC Stability Fee: 0.75%

USDC

Highest Yields: Nexo Lend at 10% APY, Aave at 0.85% APY

Top Stories

DOJ asks for independent probe into FTX bankruptcy, a likely tactic to gather evidence on alleged fraud

Russia's Sber bank integrates Metamask into its blockchain platform

Compound Caps Borrowing Levels for 10 Assets to Reduce Risk

Aave temporarily freezes lending markets to fend off further attacks

Stat Box

Total Value Locked: $42.61B (up 3.9% since last week)

DeFi Market Cap: $36.26B (up 6.5%)

DEX Weekly Volume: $9B

Bonus Reads

[Vishal Chawla – The Block] – MakerDAO is voting on increasing yield for the dai stablecoin

[Samuel Haig – The Defiant] – Hacker Makes Off With Millions After Minting Six Quadrillion of Ankr’s BNB Staking Tokens

[Callan Quinn – The Block] – WEF denies it asked Shiba Inu to work with them on metaverse global policy

[Tim Copeland – The Block] – Polygon bridge holds $27 million of unclaimed funds, ZenGo finds