This Week in DeFi - April 22

This week, Tron announces a stablecoin with 30% yield, Optimism may by launching a token, and Framework Ventures announces a $400M web3 fund.

To the DeFi community,

This week Tron crashed the algorithmic stablecoin party, announcing that it will launch its very own USDD stablecoin May 5th. The coin will be supported with TRX and $10 billion worth of crypto reserves – as well as offering 30% interest rate. This may be one to watch, as it attracts liquidity away from the dwindling UST and anchor protocol, as well as stealing the thunder from NEAR Protocol's budding USN.

Ethereum scaling platform Optimism may be the next Layer-2 solution to release its own token, following a development team blog post laying out plans for a move to community ownership and governance. Sparking additional excitement was a recently-discovered Coinbase price page for an Optimism $OP token – providing further evidence of a possible airdrop or other token distribution scheme.

Framework Ventures announces a new $400M Web3 fund directed at decentralized finance startups, as well as a significant allocation towards the blockchain gaming sector. It will be Framework’s third investment fund.

MakerDAO branches out to Ethereum Layer-2 scaling solution, StarkNet, to facilitate a cheaper Dai stablecoin ecosystem. The expansion will take place in four phases, beginning with a bridge that goes live toward the end of this month.

The algorithmic stablecoin craze has now expanded across almost every major blockchain, with each Layer-1 protocol now appearing to have announced its very own crypto-backed algorithmic solution. A large proportion of these stablecoins are accompanied by savings rate DApps that offer tremendous yields, in many cases designed to attract short-term liquidity into their respective ecosystems. With interest rates upwards of 20% (and now as high as 30% on the way for Tron's USDD), a majority of these new stablecoins are enticing participation through long-term unsustainable yields – in most cases, subsidized by "yield reserves" funded by development teams or governance systems.

We can expect a short-term disruption across stablecoin markets as participants chase the highest yields for their capital – but this phase may be relatively short-lived. Eventually the yield reserves subsidizing these outsized, fixed-rate returns will run dry and capital will trickle back into long-term sustainable models. For now, however, we can expect some stablecoin market chaos.

Thanks to our partner:

Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review.

Interest Rates

DAI

Highest Yields: Nexo Lend at 9.02% APY, BlockFi at 8.50% APY

Cheapest Loans: Celsius at 1.00%, Aave at 3.25% APY

MakerDAO Updates

DAI Savings Rate: 0.01%

Base Fee: 0.00%

ETH Stability Fee: 0.50%

USDC Stability Fee: 0.00%

WBTC Stability Fee: 0.75%

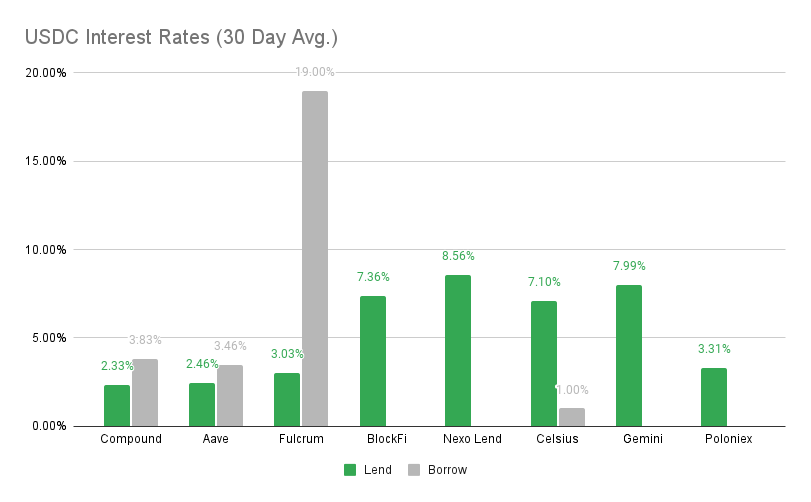

USDC

Highest Yields: Nexo Lend at 9.02% APY, BlockFi at 7.36% APY

Cheapest Loans: Celsius at 1.00%, Aave at 3.46% APY

Top Stories

Goldman Sachs Reportedly Keen to Forge Ties With FTX

Coinbase NFT Marketplace Goes Live. Can It Rival OpenSea?

Sweden, EU Discussed Bitcoin Proof-of-Work Ban

KuCoin Launches $100M Web3 Creators Fund

Stat Box

Total Value Locked: $76.29B (down 0.50% since last week)

DeFi Market Cap: $124.82B (up 3.21%%)

DEX Weekly Volume: $14B (down 22.22%)

DAI Supply: 8.71B (down 0.91%%)

Bonus Reads

[Yogita Khatri - The Block] – Aurora-based DeFi protocol Bastion raises $9 million in funding led by Three Arrows Capital

[Samuel Haig – The Defiant] – Why Compound Might Ditch its Yield Farmers

[Brian Quarmby – Cointelegraph] – Derivatives exchange dYdX to become '100% decentralized by EOY'

[Osato Avan-Nomayo – The Block] – Kadena announces $100 million grant program for web3 developers